How to sell your inherited property at the best price: Tips and effective strategies

18 August 2023

Table of Contents

ToggleSometimes, when we receive an inherited property, we face complicated and difficult situations to deal with, especially when the property is shared among several siblings. If you find yourself in this situation, it is important to understand that there are certain rules that you must follow if you want to sell an inherited house.

But, you have nothing to worry about, because in this article we will try to provide you with a detailed guide on the procedures you will have to follow in order to sell an inherited house.

Here you will find all the information you need to successfully sell your inherited house.

Procedures for selling an inherited house

Acceptance of the inheritance

Before starting any procedure related to the sale of an inherited house, it is necessary to accept the inheritance and for that, you need to gather a series of documents:

- Death certificate issued by the Civil Registry of the place where the death of the person leaving the inheritance has occurred, indicating the date and place where the death has taken place.

- Certificate of last will and testament issued by the Ministry of Justice, which certifies whether the deceased person left a will or not, and if so, at which Notary’s office it was granted.

- Will, if there is one, along with a copy authorized by a Notary Public. If the deceased died without executing a will, those who are to be declared heirs will request a Notoriety Act of declaration of heirs issued by a Notary.

- Inheritance Deed in the presence of a Notary, where after identifying all the heirs and making an inventory of the deceased person’s assets, we proceed with the partition of the inheritance or distribution of the assets among the heirs, in the proportion that corresponds to each one of them.

Inheritance tax liquidation

When a property is inherited, it is necessary to face the corresponding fiscal responsibilities. In particular, the heirs must pay the Inheritance and Gift Tax within six months of the death of the owner of the property.

This tax is calculated according to several factors:

- The autonomous community in which you must liquidate the tax (where the deceased person had his/her habitual residence). Inheritances from parents to children have a 99% inheritance tax credit in some autonomous communities.

- The level of kinship between the deceased and the heirs.

- The value of the inheritance received (value of the inherited assets).

Settlement of municipal capital gains tax

Capital gains tax is a municipal tax levied on the increase of land value. In the case of an inheritance, such increase is calculated from the time the deceased person acquired the property until the heirs receive it as inheritance.

It is also paid within the first six months after the death of the owner of the property, at the town hall where the inherited property is located.

Both taxes, Inheritance and Gift Tax and Municipal Capital Gains Tax, expire after four years, counted from the last day in which the liquidation of each one could be submitted.

The last aspect, related to this matter, is knowing which taxes are to be paid when selling an inherited house. When a house is sold, it is declared in the IRPF, in the year following the sale, according to the capital gain obtained.

Registering the property in the Real Estate Registration Office

The next step that must be taken, before proceeding to the sale of an inherited house, is to register the house in the Property Registration Office in the name of the heirs, new owners of the house, according to their respective share of participation.

Requirements to sell an inherited house

When the house is already registered in the Property Registration Office in the name of the heirs, the procedures for its sale can be initiated.

As the house belongs to several heirs, sometimes there are conflicts between them. For that reason, it is convenient, in such cases, to rely on specialized professional advice, since it is essential that everyone agrees to sell and, above all, on the conditions of sale of the inherited property.

Can I sell my part of an inherited house?

This is a very frequent question that we often get from some of our clients at Monserrate Inmobiliaria, especially when the heirs cannot come to an agreement.

The best solution is for the heirs to come to an agreement, but if this is not possible, there are three ways to sell a house if an heir opposes:

Extinction of the community property

It means that the heir who does not want to sell keeps the house and compensates economically the other heirs according to the part that belongs to them.

What inconvenience can this solution bring? Well, the extinction of the community property is taxed in the IRPF for entailing an increase in the estate of the one who does not keep the property, if the value of the property when dissolving the co-ownership, is higher than the one it was when it inherited.

Sale of pro indiviso

Heirs who wish to sell can transfer their percentage of the property to a company. This procedure has some disadvantages:

- Companies buying pro indivisos usually pay prices 35% to 50% lower than their market values.

- If a company makes you an offer for your share of the property, the other owners have priority to buy your share of the property on those terms (this is known as the right of first refusal and withdrawal).

- The other heirs may be upset at having to split the property with a third person.

Division of the common property

To seek legal advice by filing a lawsuit for the division of the common property. This procedure implies, in most cases, that the judge orders the sale of the property at public auction and divides the profit among the co-owners.

Disadvantages of this alternative:

- The costs associated with a court proceeding, which are high.

- The time it takes to obtain a judicial resolution (more than one year).

- The price of the sale of the inherited house can be up to 30% lower.

- The breakdown of family relationships due to a judicial process.

As we had already mentioned, the best solution if you want to avoid the inconveniences associated with the three ways of selling a property if an heir opposes, is to reach an agreement.

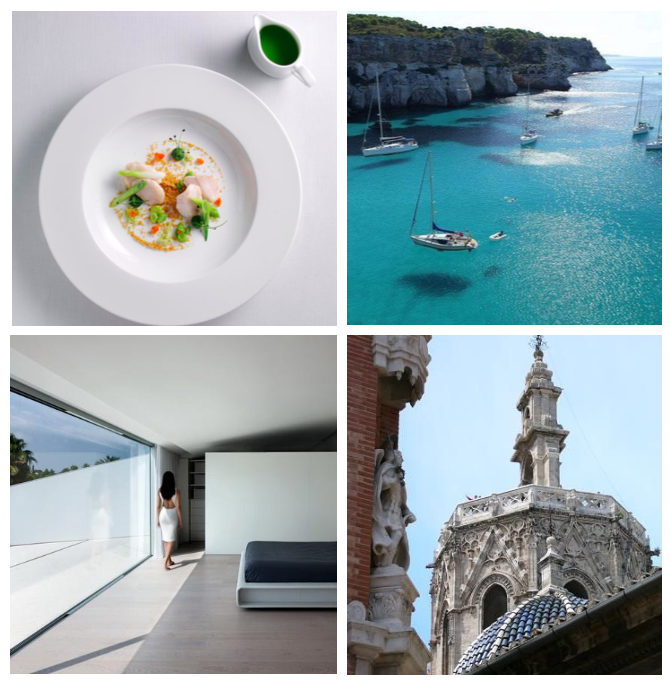

If you want to sell an inherited house, and you are several heirs, our legal department can help you in the steps to manage the inheritance and, what matters the most, to come to an agreement to sell the property. Do not hesitate to contact us and discover our luxury properties in Valencia.

Write to us, and one of our premium home agents will get in touch with you.

Other properties

Buy

1.300.000€

Stunning château, in the Sierra Calderona

Náquera

F106

652 sqm House

6

Rent, Buy

6.500€, 1.300.000€

Harmony and luxury available at Jaume Roig

Valencia

A5345

236 sqm House

4

2

Buy

990.000€

Renewed 4 stories home in Alfinach

Puzol / Puçol

V267

300 sqm House

4

3

Buy

2.200.000€

Distinguished property, Plà del Remèi

Valencia

V5080

368 sqm House

5

5

Buy

750.000€

Elegant new build semi-detached houses in Campolivar

Godella

ON705

228 sqm

5

3

Buy

1.300.000€

Exclusive property in Marqués de Sotelo Ave.

Valencia

V5224

225 sqm House

3

2

Buy

1.050.000€

DOWNPAID

Puzol / Puçol

VA102

337 sqm House

5

4

Buy

2.800.000€

Exclusive Ibiza's architecture villa in Santa Bárbara

Rocafort

V778

802 sqm House

7

7

Buy

915.000€

Penthouse at Monasterios Residences II

Sagunto / Sagunt

ON106V13

162 sqm

3

2

Buy

1.600.000€

Outsanding passive house in Alfinach

Puzol / Puçol

ON201

345 sqm

4

4

Rent, Buy

4.000€, 1.200.000€

Dreamed property in Ruzafa

Valencia

V5144

317 sqm House

5

4

Buy

680.000€

Gorgeous villa, sea views

Sagunto / Sagunt

V612

474 sqm House

6

2

Buy

1.380.000€

Exclusive and modern property in Campolivar

Godella

V776

495 sqm House

6

3

Buy

660.000€

Fabulous plot in Torre en Conill in front of the Escorpión

Bétera

S702

1.600 sqm

Rent

1.800€

RESERVED: Wonderful apartment with views of the Plaza del Patriarca

A5323

94 sqm House

2

1

Buy

800.000€

SOLD

Ontinyent

F107

970 sqm House

6

8

Rent

1.600€

Fantastic super bright penthouse in Cortes Valencianas

Valencia

A5351

105 sqm House

2

1

Buy

520.000€

DOWNPAID

Dénia

V812

233 sqm House

Buy

1.700.000€

Large luxury flat at L’Eixample

Valencia

V5232

267 sqm House

6

3

Buy

505.000€

Stunning New Build Townhouses in Campolivar

Godella

ON706

138 sqm

4

3

Buy

2.900.000€

Exclusive and luxurious new construction

Puzol / Puçol

V169

840 sqm House

8

7

Rent, Buy

8.000€, 3.500.000€

Dream villa sorounded by nature

Náquera

V748

1.442 sqm House

16

11

Rent

3.500€

Rented

Valencia

A5349

174 sqm House

4

3

Rent

2.000€

Semi-Detached Villa Rental in avenida de los Alemendros

Godella

A710

275 sqm House

3

3

Rent

1.600€

Rented

Valencia

A5347

125 sqm House

3

2

Buy

3.600.000€

Sold

Puzol / Puçol

VA122

610 sqm House

6

6

Buy

1.500.000€

Luxurious house 1.400 sqm plot

Puzol / Puçol

V135

353 sqm House

4

5

Rent

3.000€

Rented: Dream penthouse with incredible views

Valencia

A5344

155 sqm House

2

2

Rent

3.000€

Rented

Valencia

A5342

140 sqm House

3

2

Buy

1.300.000€

Spectacular designer home in Picanya

Valencia

V777

380 sqm House

4

4

Artículos Relacionados

Discover the exclusive country club of Los Monasterios

May 19, 2023

Leer más

Investing in Luxury Real Estate in Valencia: A Golden Opportunity for International Buyers

July 10, 2023

Leer más

The 6 best things of living in Valencia

May 9, 2023

Leer más

Advantages of investing in luxury real estate

January 2, 2023

Leer más

International Buyer’s Guide: Acquiring Luxury Properties in Valencia’s Exclusive Urbanizations

July 21, 2023

Leer más

American School of Valencia: The best educational and life choice for your family

February 13, 2023

Leer más

Residency Benefits Through Real Estate Investment in Spain: Visa and Residency Permits for International Buyer

August 18, 2023

Leer más

What are the best areas in Spain to invest in real estate?

September 27, 2023

Leer más

The Process of Buying Property in Spain for International Buyers: Key Considerations and Steps

October 11, 2023

Leer más